All Categories

Featured

Table of Contents

It's essential to bear in mind that SEC regulations for accredited financiers are created to protect investors. Without oversight from economic regulatory authorities, the SEC simply can't review the danger and incentive of these financial investments, so they can't offer details to educate the typical capitalist.

The idea is that capitalists that make sufficient earnings or have adequate riches have the ability to absorb the threat much better than investors with lower revenue or less wealth. accredited investor investment opportunities. As a recognized investor, you are expected to finish your own due diligence before adding any type of possession to your financial investment profile. As long as you satisfy among the complying with 4 demands, you qualify as a certified investor: You have actually gained $200,000 or more in gross earnings as an individual, every year, for the previous two years

You and your partner have actually had a consolidated gross income of $300,000 or even more, each year, for the past 2 years. And you anticipate this level of revenue to proceed.

Leading Accredited Investor Crowdfunding Opportunities

Or all equity owners in the business certify as certified financiers. Being a recognized financier opens doors to financial investment chances that you can't access otherwise. As soon as you're accredited, you have the alternative to invest in uncontrolled safety and securities, that includes some outstanding investment chances in the realty market. There is a vast array of genuine estate investing techniques readily available to financiers that don't presently fulfill the SEC's demands for accreditation.

Coming to be an accredited financier is simply an issue of proving that you meet the SEC's demands. To confirm your earnings, you can supply documents like: Tax return for the previous 2 years, Pay stubs for the past 2 years, or W2s for the previous 2 years. To confirm your web well worth, you can supply your account statements for all your possessions and liabilities, including: Savings and inspecting accounts, Financial investment accounts, Outstanding loans, And real estate holdings.

Elite Accredited Investor Crowdfunding Opportunities

You can have your attorney or certified public accountant draft a verification letter, verifying that they have actually assessed your financials and that you fulfill the needs for a certified financier. However it might be extra cost-efficient to use a solution particularly created to validate certified financier standings, such as EarlyIQ or .

For example, if you join the realty financial investment firm, Gatsby Financial investment, your accredited financier application will be processed with VerifyInvestor.com at no charge to you. The terms angel financiers, advanced financiers, and accredited investors are usually utilized interchangeably, however there are subtle distinctions. Angel capitalists supply venture capital for startups and local business for possession equity in the business.

Generally, anyone that is accredited is thought to be a sophisticated financier. People and service entities that preserve high revenues or significant wide range are assumed to have sensible knowledge of finance, qualifying as advanced. Yes, global investors can become certified by American financial criteria. The income/net worth requirements continue to be the same for international financiers.

Here are the very best investment opportunities for accredited financiers in real estate. is when investors merge their funds to purchase or remodel a residential or commercial property, after that share in the profits. Crowdfunding has turned into one of one of the most preferred methods of buying real estate online considering that the JOBS Act of 2012 enabled crowdfunding platforms to supply shares of realty tasks to the public.

Cost-Effective Accredited Investor Real Estate Investment Networks

Some crowdfunded property investments do not require accreditation, but the jobs with the biggest prospective rewards are generally reserved for accredited investors. The difference between projects that accept non-accredited financiers and those that only accept certified capitalists generally comes down to the minimum financial investment amount. The SEC presently restricts non-accredited financiers, that earn less than $107,000 per year) to $2,200 (or 5% of your yearly earnings or internet worth, whichever is less, if that quantity is greater than $2,200) of financial investment capital each year.

It is very similar to genuine estate crowdfunding; the process is essentially the exact same, and it comes with all the very same advantages as crowdfunding. Genuine estate submission uses a stable LLC or Statutory Trust possession model, with all financiers offering as participants of the entity that possesses the underlying genuine estate, and a distribute who facilitates the job.

a company that purchases income-generating actual estate and shares the rental income from the residential or commercial properties with investors in the form of dividends. REITs can be publicly traded, in which instance they are controlled and offered to non-accredited financiers. Or they can be exclusive, in which situation you would need to be certified to spend.

Favored Private Equity For Accredited Investors

It is necessary to note that REITs usually come with several costs. Management fees for a personal REIT can be 1-2% of your total equity annually Purchase charges for brand-new purchases can pertain to 1-2% of the purchase rate. Management charges can complete (accredited investor opportunities).1 -.2% yearly. And you may have performance-based fees of 20-30% of the exclusive fund's revenues.

But, while REITs concentrate on tenant-occupied homes with stable rental income, personal equity realty firms concentrate on property advancement. These companies frequently develop a story of raw land right into an income-generating home like an apartment complicated or retail buying center. Similar to exclusive REITs, financiers secretive equity endeavors generally require to be recognized.

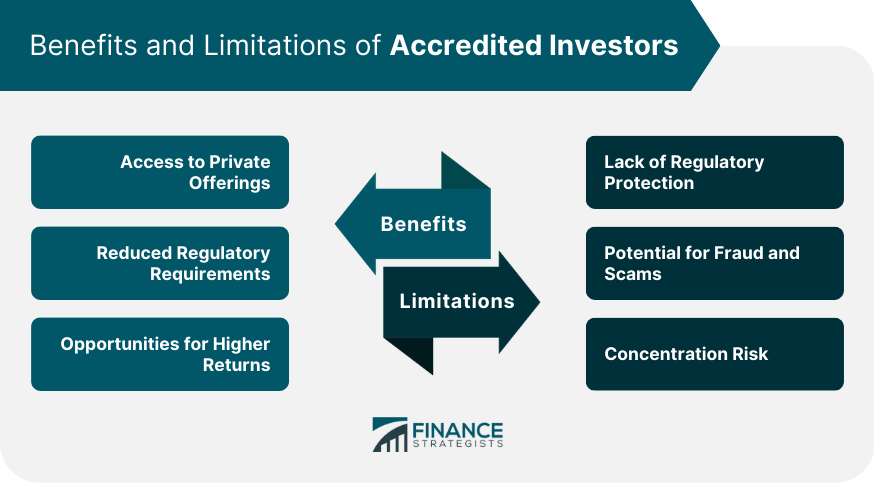

The SEC's definition of recognized investors is created to determine people and entities deemed economically sophisticated and efficient in evaluating and joining specific kinds of personal financial investments that may not be readily available to the basic public. Importance of Accredited Capitalist Condition: Verdict: In conclusion, being a recognized financier brings substantial relevance in the globe of finance and financial investments.

Advanced Accredited Investor Real Estate Investment Networks

By satisfying the requirements for certified financier condition, individuals show their economic class and get to a world of investment possibilities that have the prospective to generate substantial returns and add to long-lasting economic success (accredited investor platforms). Whether it's spending in startups, real estate endeavors, exclusive equity funds, or other alternate possessions, certified financiers have the advantage of checking out a varied range of investment choices and building wealth on their very own terms

Accredited financiers include high-net-worth individuals, banks, insurance provider, brokers, and trusts. Recognized capitalists are specified by the SEC as certified to spend in complicated or innovative kinds of safeties that are not very closely controlled. Particular criteria must be satisfied, such as having an average yearly revenue over $200,000 ($300,000 with a spouse or cohabitant) or working in the monetary industry.

Unregistered protections are naturally riskier since they do not have the regular disclosure requirements that feature SEC enrollment. Investopedia/ Katie Kerpel Accredited capitalists have blessed access to pre-IPO business, financial backing business, hedge funds, angel investments, and numerous offers entailing complicated and higher-risk investments and instruments. A firm that is looking for to increase a round of financing may choose to straight come close to certified financiers.

Table of Contents

Latest Posts

Unpaid Tax Homes

Foreclosure Property Tax Liability

Tax Delinquent Land Near Me

More

Latest Posts

Unpaid Tax Homes

Foreclosure Property Tax Liability

Tax Delinquent Land Near Me