All Categories

Featured

Table of Contents

- – Exclusive Accredited Investor Platforms for Ac...

- – Expert-Driven Accredited Investor Wealth-build...

- – Personalized Accredited Investor Crowdfunding...

- – Innovative Accredited Investor Real Estate In...

- – Optimized Accredited Investor Investment Ret...

- – Dependable Accredited Investor Crowdfunding ...

If you're a financial investment expert with a Collection 7, Series 65 or Collection 82 or around to turn into one sometimes you're considered a recognized capitalist. Exact same if you go to the director or above degree of the business marketing the safety and security, or if you're a knowledgeable employee of an exclusive fund that you would love to purchase.

There are a large variety of chances for accredited capitalists. The online investing platform Yield Street, for instance, supplies art, crypto, realty, financial backing, temporary notes, legal financing funds and other customized asset courses. Other platforms, AcreTrader and Percent, for example, offer accessibility to farmland financial investments, merchant cash money advances and even more.

Typically speaking, these kinds of chances aren't listed they originate from that you understand and what you're associated with. accredited investor real estate deals. For some, this might imply very early rounds of startup investing, bush funds or various other sorts of personal funds. Your investment advisor may additionally present you particular economic tools or financial investments to think about if you're an accredited financier.

Remember, the intent behind stopping retail capitalists from purchasing unregistered safeties is to shield those who do not have the economic means to withstand large losses.

Exclusive Accredited Investor Platforms for Accredited Investors

A private have to have a total assets over $1 million, leaving out the primary residence (individually or with partner or partner), to qualify as an accredited financier - real estate investments for accredited investors. Demonstrating adequate education and learning or task experience, being a signed up broker or financial investment expert, or having particular specialist accreditations can likewise certify an individual as a recognized investor

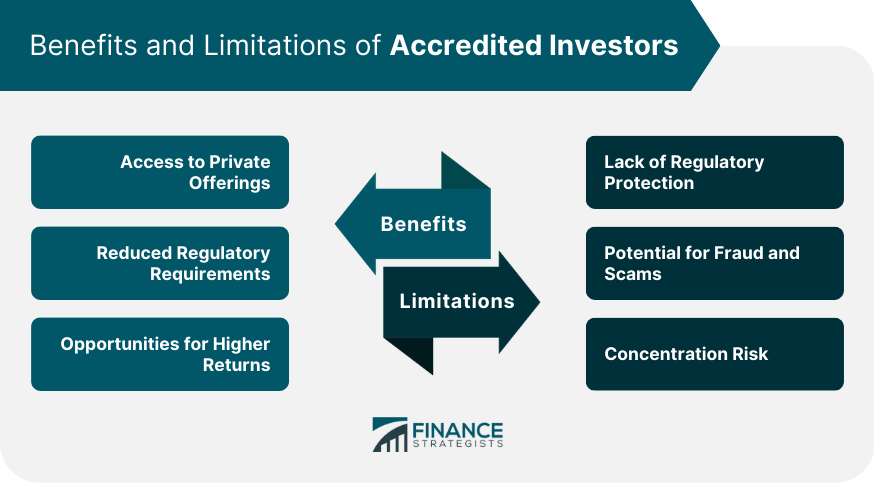

Recognized capitalists have accessibility to investments not registered with the SEC and can include a "spousal equivalent" when identifying qualification. Recognized investors might face prospective losses from riskier financial investments and have to confirm financial class to take part in uncontrolled investments. Approved investor condition issues because it determines eligibility for financial investment possibilities not available to the general public, such as private placements, endeavor funding, hedge funds, and angel financial investments.

To take part, approved capitalists should approach the provider of unregistered securities, who may need them to complete a survey and supply monetary files, such as income tax return, W-2 kinds, and account declarations, to confirm their status. Rules for certified financiers are managed by the U.S. Securities and Exchange Compensation (SEC), making certain that they satisfy particular economic and professional requirements.

Expert-Driven Accredited Investor Wealth-building Opportunities

This growth of the recognized investor pool is intended to preserve capitalist defense while providing greater access to unregistered financial investments for those with the needed economic class and risk resistance.

The contemporary period has opened up the door to numerous certified financier opportunities that it can make you lightheaded. It's one point to earn money; it's quite one more holding onto it and, without a doubt, doing what's required to make it expand. The arena has numerous verticals covering conventional asset courses like equities, bonds, REITs and shared funds.

The issue? While these approved investor financial investment opportunities are amazing, it can be tough to know where to start. If you wish to know the most effective financial investments for recognized financiers, you remain in the right place. Keep reviewing for a checklist of the 10 best platforms and chances for recognized investors.

Personalized Accredited Investor Crowdfunding Opportunities

First, let's make certain we're on the exact same page concerning what an accredited financier is. You can qualify as an accredited financier in either methods: A) You have the best licensure a Series 7, Collection 65, or Series 82 FINRA permit. B) You satisfy the economic criteria.

Check out the Whether you're an accredited financier currently or just want to be informed for when you are, here are the finest accredited financier investments to take into consideration: Score: 8/10 Minimum to start: $10,000 Equitybee deals accredited investors the chance to buy firms before they go public. This indicates you do not need to wait on a company to IPO to end up being a stakeholder.

There are a lot of big-name (but still not public) firms presently available on Equitybee: Epic Games, Stripes, and Waymo, to name a few. Once you have actually chosen a firm, you can money a worker's stock options via the platform. Easily, you're a stakeholder. private placements for accredited investors. Currently, when a successful liquidity occasion occurs, you're entitled to a portion of the proceeds.

The ability to obtain accessibility to pre-IPO companies might be worth it for some investors. The "one-stop-shop" facet alone may make it one of the top certified financiers' financial investments, but there's also more to like concerning the platform.

Innovative Accredited Investor Real Estate Investment Networks

(Resource: Yieldstreet) Score: 8/10 Minimum to start: No lower than $10,000; most chances vary between $15K and $40K Affluent capitalists regularly turn to farmland to branch out and develop their portfolios. Why? Well, consider this: Between 1992-2020, farmland returned 11% each year, and only knowledgeable 6.9% volatility of return. And also, it has a reduced correlation to the supply market than the majority of alternative assets.

AcreTrader is just available to certified financiers. The system offers fractional farmland investing, so you can spend at a reduced price than getting the land outright.

Optimized Accredited Investor Investment Returns for Accredited Investment Results

That implies you can rest simple with the reality that they have actually done their due persistance. And also, they do all the admin and outside monitoring. In terms of just how you get paid, AcreTrader disburses annual revenue to capitalists. According to their web site, this has actually traditionally yielded 3-5% for lower-risk financial investments. However, there's a potential for higher returns over the past twenty years, UNITED STATE

It's not hard to see why. Let's start with the cash. Since February 2024, CrowdStreet has actually moneyed over 787 bargains, an overall of $4.3 billion invested. They boast a 16.7% recognized IRR and an ordinary hold duration of 3.1 years. (Resource: CrowdStreet) Next off up, the projects. Once you've offered proof of accreditation and established your account, you'll obtain accessibility to the Industry, which features both equity and debt investment chances which could be multifamily homes or retail, office, and even land opportunities.

On Percent, you can additionally buy the Percent Combined Note, or a fund of various credit scores offerings. It's a very easy means to branch out, but it does have greater minimums than a few of the other possibilities on the system. By the method, the minimum for most opportunities on Percent is rather tiny for this list simply $500.

Dependable Accredited Investor Crowdfunding Opportunities

You can both buy the main market and profession on the secondary market with other art investors. And also, Masterworks takes care of the purchase, storage, insurance, and sales of the artwork. If it sells for a profit, the earnings are distributed amongst capitalists. While Masterworks is not simply for certified financiers, there is a waitlist click listed below to explore a lot more.

Table of Contents

- – Exclusive Accredited Investor Platforms for Ac...

- – Expert-Driven Accredited Investor Wealth-build...

- – Personalized Accredited Investor Crowdfunding...

- – Innovative Accredited Investor Real Estate In...

- – Optimized Accredited Investor Investment Ret...

- – Dependable Accredited Investor Crowdfunding ...

Latest Posts

Unpaid Tax Homes

Foreclosure Property Tax Liability

Tax Delinquent Land Near Me

More

Latest Posts

Unpaid Tax Homes

Foreclosure Property Tax Liability

Tax Delinquent Land Near Me